Lenders might possibly make it easier to determine whether a zero-tax return home loan is right for you. In the event the taxable earnings is significantly below their gross annual income, a lender declaration financial might help. This may help if your income are seasonal or unpredictable. If not deduct an abundance of team expenditures, you might want to discuss any choices. Self-operating individuals can be be eligible for antique mortgage loans, nevertheless could be more out-of a problem. Talk to loan Livingston quicken loans providers and stay upfront about your requires. If an individual financial actually guaranteeing, contact another.

Be persistent and study the loan offers very carefully. Ask questions on anything that isn’t really obvious. Before you go, indication the latest paperwork and then have this new keys to your family.

Why would a loan provider N’t need an income tax Go back?

Of several mortgages are qualified mortgage loans. This means these mortgage loans has actually a limit on the points and you may charges and you may judge protections on loan providers. Lenders have to stick to the regulations set by the User Economic Protection Bureau (CFPB) once they render consumers accredited mortgages. One among these guidelines is that they need to be sure income, and so they play with tax statements to accomplish this.

Tax statements may not reflect a personal-functioning individuals actual income. This is because care about-functioning individuals constantly deduct business costs. It lowers the taxation burden and you may tends to make their money research down as opposed. Loan providers recognize that taxation statements might not be the simplest way determine borrowers’ money. They give nonqualified mortgages to aid address this problem.

Loan providers still need to make yes borrowers normally pay-off the mortgage loans. They use financial statements to confirm earnings unlike taxation statements with the help of our style of mortgages. That’s why particular loan providers label these bank declaration mortgages, to make their homebuying techniques a small much easier. If you are not yes what can work best for your requirements, ask the financial institution of your preference getting an affordability calculator that predate the loan application.

How is it Mortgage Techniques Unique of a timeless Home loan?

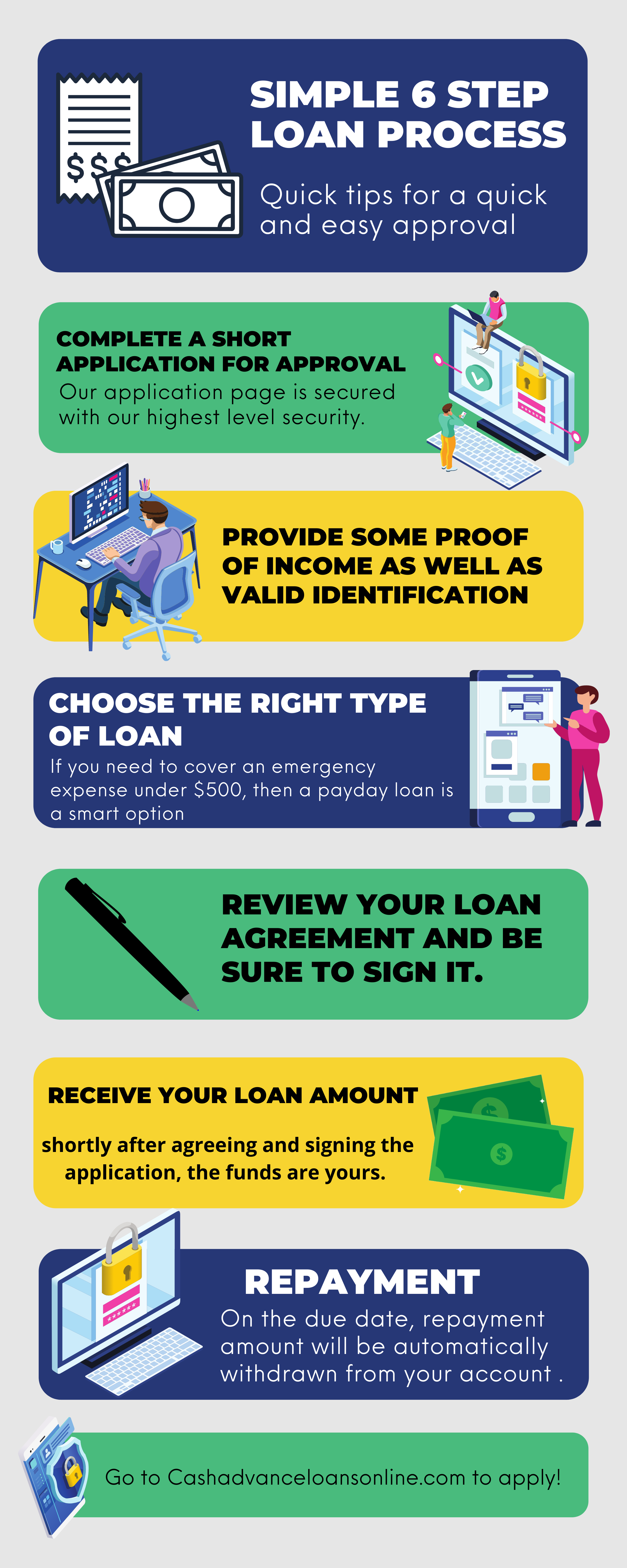

The loan processes to have a lender statement mortgage is a lot like the entire process of a timeless mortgage. Here is how the procedure works as well as the methods you really need to bring discover happy to purchase or refinance a home.

Look at the Credit

Though it actually needed, checking your own borrowing is a good foundation of to buy a beneficial home. This is also true whenever you are taking a bank statement home loan. Certain lenders will demand one to have a great credit history to approve your to have a financial statement home loan. You might also need to replace your borrowing from the bank prior to implementing, especially if your own broker has work at some predictors and you will really wants to allow you to get recognized faster. Credit ratings are normally taken for 300 so you can 850. Loan providers thought a score off 700 or maybe more to get an excellent – though it can vary. Score a free backup of one’s credit file by going to AnnualCreditReport. Feedback their statement for all the mistakes otherwise profile which do not fall in for your requirements. Get in touch with the credit bureau inside and you will assist that certain agency learn of every mistakes otherwise items you can see.

Collect Debt Records

Here is the most significant difference in a classic mortgage and you may a lender declaration financial. To own a vintage financial, you typically need to promote the one or two current financial comments. Getting a financial report financial, make an effort to promote at the very least six months off individual and you may providers financial comments. You might have to promote one year regarding statements or more. Collect any documentation of every most other earnings you will get too.

Get Preapproved

Get in touch with numerous lenders to own a quote. Allow lenders be aware that you find attractive a lender report financing. Opinion for each and every quote cautiously. Glance at the interest rate and you may costs. Prefer a loan provider and let the financial know you would want to feel preapproved. Give the bank which have any documents it must complete the preapproval techniques. The lender gives you a letter claiming you happen to be preapproved.